Funding

Funding

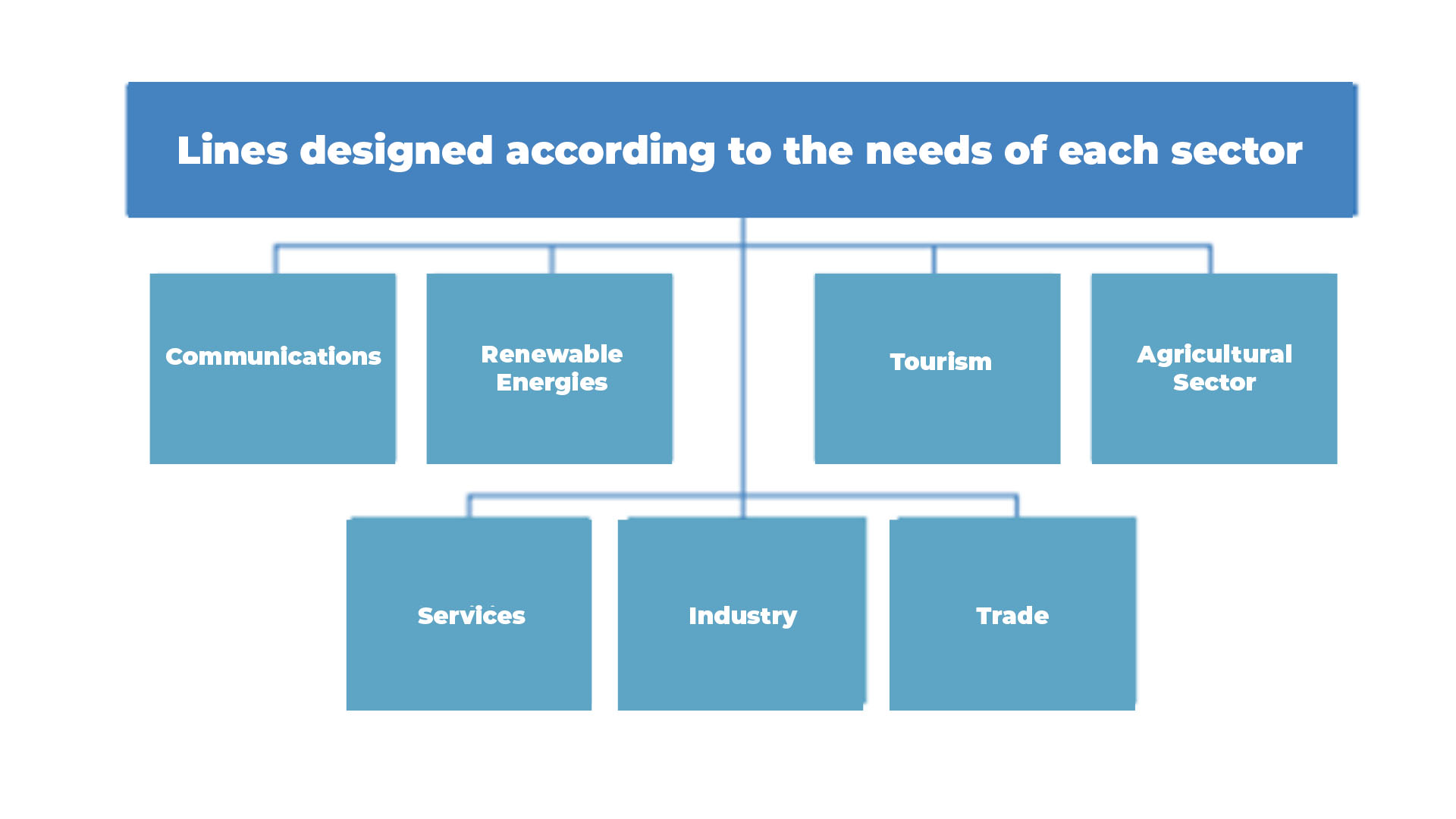

There are more than 30 lines of credit intended to finance real investment within the Province, which are granted by the Bank of La Pampa. They are long-term lines (up to seven years) which have special conditions, with interest rates that have a subsidy paid by the Government of the Province of La Pampa (up to 30%), according to the different needs of each sector.

Find more information at: https://produccion.lapampa.gob.ar/asistencia-financiera.html & https://icomexlapampa.org/images/Prestamos_financiamientos_BLP.pdf

TAX Incentives

TAX Incentives

Our Province offers tax incentives to reduce tax burden, including a reduction of up to 40% in the rates of the Gross Income Tax and the exemption of other local taxes. There is a cero-rate for sectors such as industry and mine or quarries exploitation. Besides, there is a group of tax incentives that includes the exemption of tax burden during a period of up to 5 years granted through credit given for the total salary paid to those employees who settle in the village of Casa de Piedra (La Pampa). This credit can apply to several taxes and administrative levies.

Strengthening of employment in La Pampa

Strengthening of employment in La Pampa

In order to boost formal and good-quality employment, and to improve companies’

competitiveness, the Government launched a Program for Strengthening Employment in La

Pampa that grants monthly subsidies to companies for each hired employee during a period of

15 months. During the first three months, such subsidy is doubled so as to promote the

training of employees, and during the last twelve months the amount given will cover 50% of

the total amount. All these amounts will be updated according to the salary index provided by

INDEC (National Institute of Statistics and Censuses of the Argentine Republic).

Find more information at: http://empleolapampa.com.ar/publico/primer_empleo.html

Guaranties

Guaranties

The Province of La Pampa offers a Pampean Guaranty Fund (“FOGAPAM” in Spanish) to small, very small and medium enterprises. This is a unique tool, as it allows SMEs and very small companies not only to have a guarantor to obtain credit in the bank financial system, but also to obtain funding in the capital market and to develop new financial tools to stimulate their investment.

Find more information at https://fogapam.com.ar/

TAX-FREE Zone

TAX-FREE Zone

The Province of La Pampa has a Tax-free Zone located in a strategic area of Argentina, in the city of General Pico. This location makes the access to the most important markets easier and the supply lines shorter. This Zone has special regulations in terms of taxes, customs, exchange rates, foreign trade, and capital investment, and offers multiple benefits for those companies that are willing to settle here. In consequence, this Zone has been a major promoter of the creation of companies and jobs in this region of the country.

Check the advantages of this Tax-free Zone at: http://www.zflapampa.com.ar/es/impositivos-y-aduaneros/

Industrial Parks

Industrial Parks

In the Province of La Pampa there are, as well, 22 cities with Industrial Parks. Some of these Parks are already well established and have at least three companies working there and expanding their facilities and services. There are other Parks which are in the process of improving their facilities and services, or which have companies still building their premises. The cities of Santa Rosa, 25 de Mayo and General Pico have two Industrial Parks each. All of the Industrial Parks in the Province are public.